6 min read |

Symbo’s customer-centric approach to insurance, ensures all key aspects of customer experience are easy and intuitive for the end user. Right from communicating the coverage details and inclusions, to ensuring a hassle free claims experience, we strive to delight your customers at every step.

This document details out the key aspects of the policy issuance process and the claims experience for the end user.

The Program Structure

Symbo makes the Partner the Master Policy holder of the insurance product under which the Partner is authorised to administer the policies to individual customers. There is a one time process to register with the Insurance company as the Master policy holder that requires submission of your company documents (PAN card, GST certificate, etc) and a minimum Cash deposit balance, which is an advance against the policies.

Stay updated with us

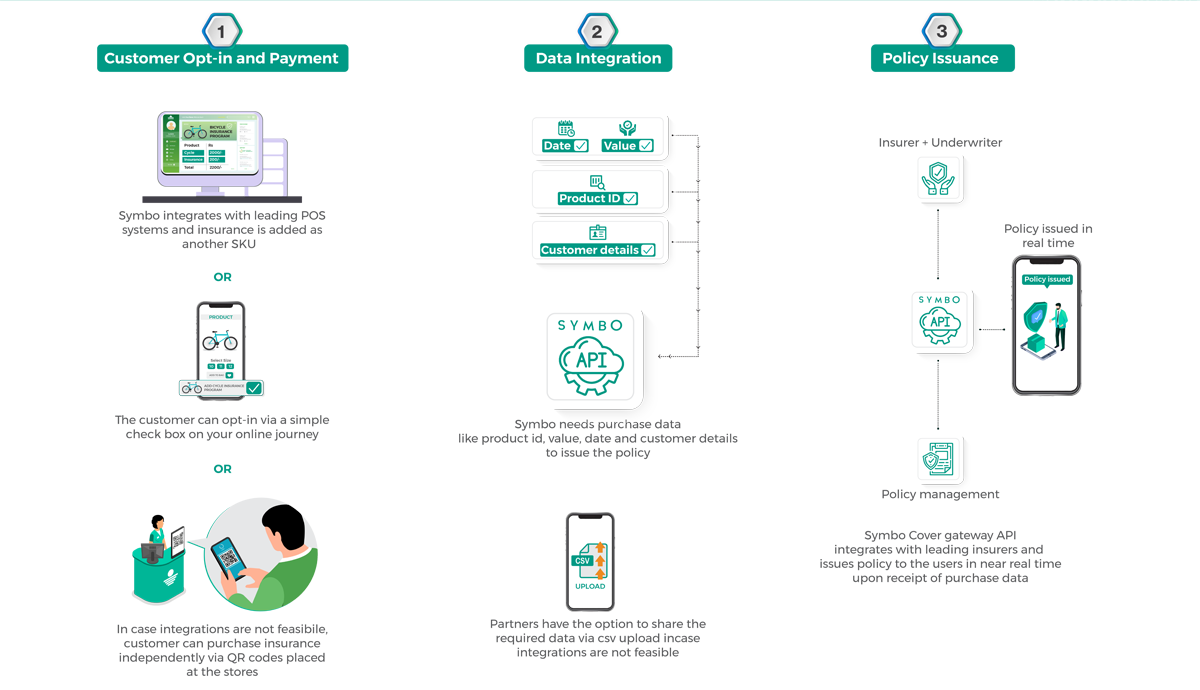

Policy Issuance Process

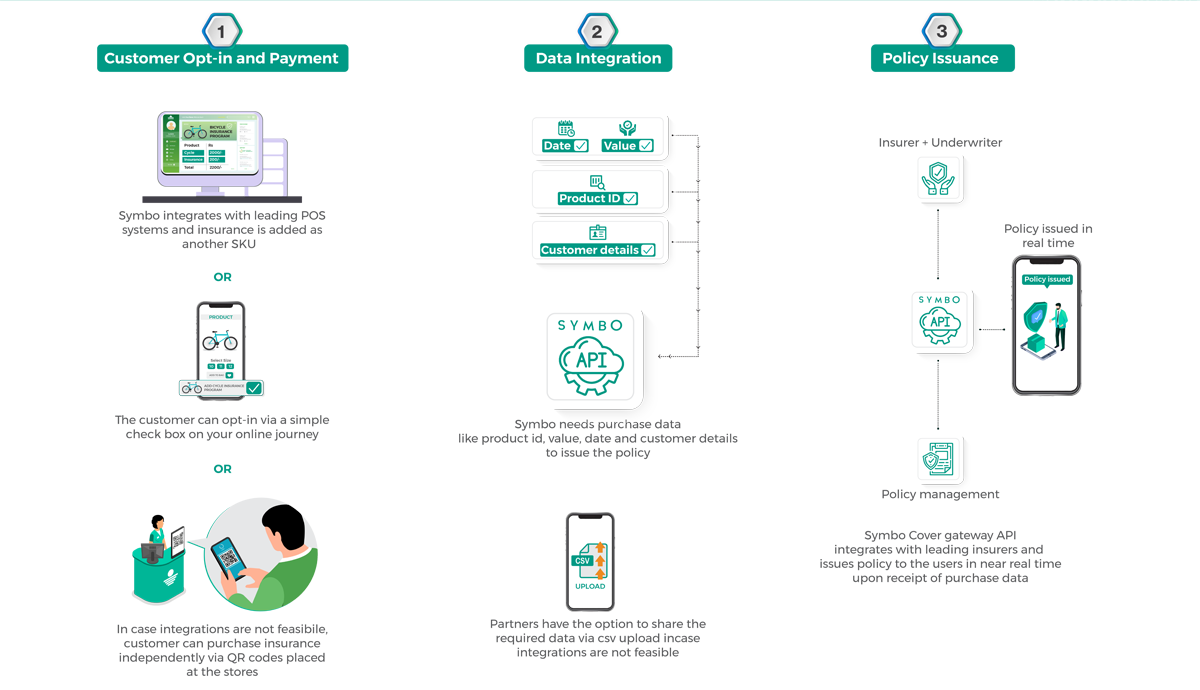

Symbo has multiple options to seamlessly integrate the insurance buying experience with your current purchase journey.

The buying journey has 3 steps

- Customer Opt-in

- Data Integration

- Policy Issuance

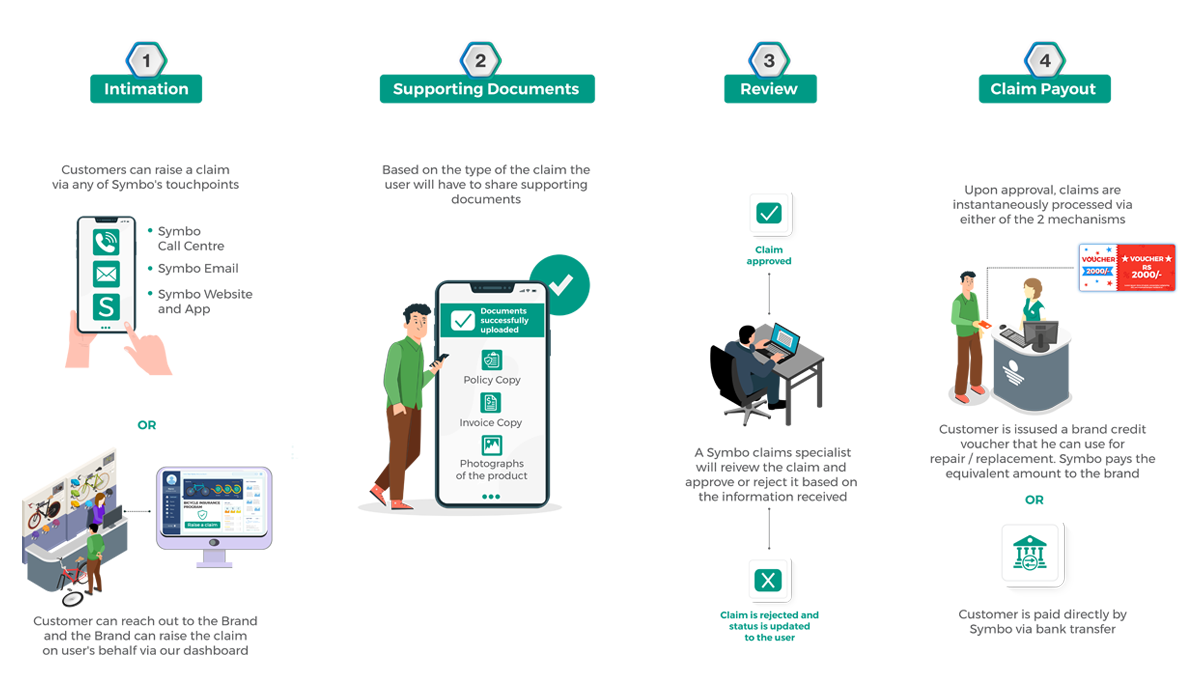

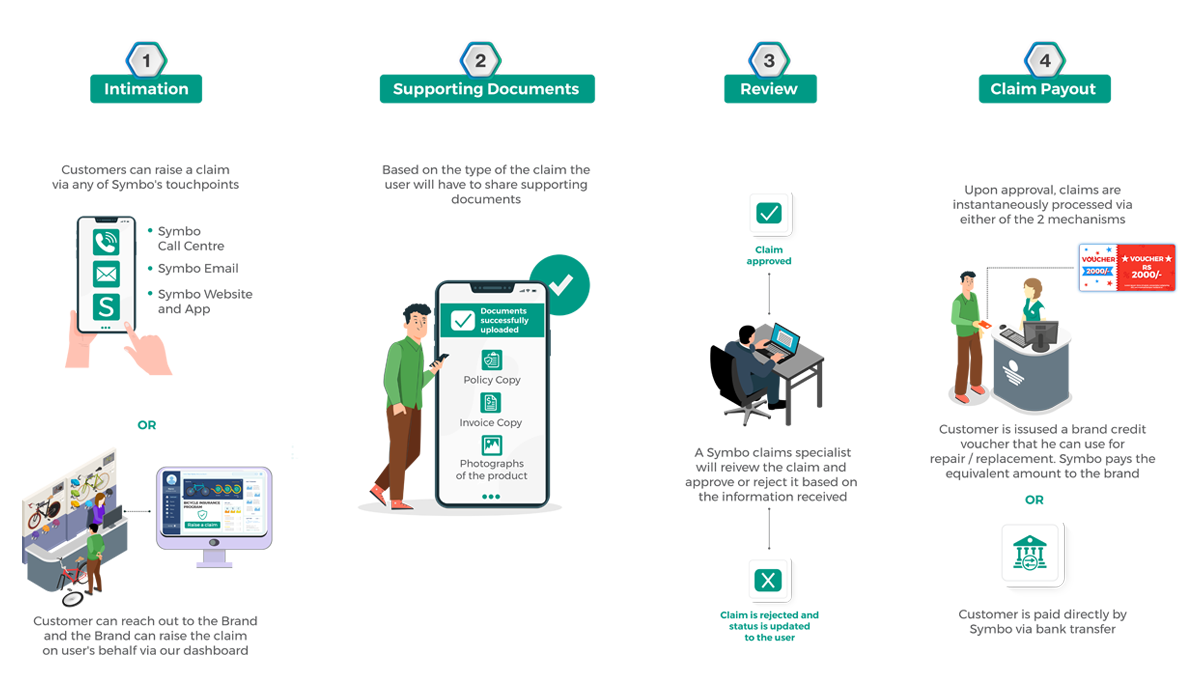

Claims Process

Our platform capabilities combined with our super efficient claims management team, ensures a delightful and stress free claims experience.

A customer can get his claim processed in 4 easy steps:

- Intimation

- Supporting Documents

- Review

- Claim Payout